Assume that the central bank purchases government securities in the open market. If the nation has low mobility international capital markets and a flexible exchange rate system, what happens to the real GDP and current international transactions in the context of the Three-Sector-Model?

a. Real GDP rises, and current international transactions become more positive (or less negative).

b. Real GDP rises, and current international transactions become more negative (or less positive).

c. Real GDP and current international transactions remain the same.

d. Real GDP rises, and current international transactions remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

The income distribution of the United States is basically the nation's answer to the

A. WHAT question. B. FOR WHOM question. C. HOW question. D. WHAT, HOW, and FOR WHOM questions.

Why do economists view structural budget deficit as a good measure of the direction of the fiscal policy?

What will be an ideal response?

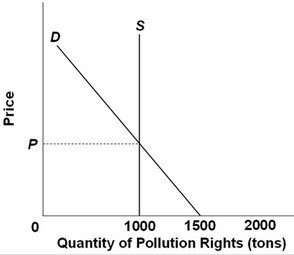

Refer to the above diagram illustrating a market for pollution rights in which government has fixed the supply of rights at 1,000 tons. If there were no market for pollution rights in this case, the volume of pollutants discharged would be:

Refer to the above diagram illustrating a market for pollution rights in which government has fixed the supply of rights at 1,000 tons. If there were no market for pollution rights in this case, the volume of pollutants discharged would be:

A. zero. B. 2,000 tons. C. 1,000 tons. D. 1,500 tons.

The formula for elasticity of demand (in words) is

A. the change in quantity divided by the change in price. B. the percentage change in quantity divided by the percentage change in price. C. the percentage change in price divided by the percentage change in quantity. D. the change in price divided by the change in quantity.