Suppose the supply of non-OPEC oil increases due to new petroleum discoveries in other countries. What happens to the price of oil on the world market?

A) Increases

B) Decreases

C) Remains the same

D) We do not have enough information to answer this question.

B

You might also like to view...

Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the GDP Price Index and net nonreserve international borrowing/lending balance in the context of the Three-Sector-Model? a. The GDP

Price Index falls and net nonreserve international borrowing/lending balance becomes more negative (or less positive). b. The GDP Price Index rises and net nonreserve international borrowing/lending balance becomes more negative (or less positive). c. The GDP Price Index falls and net nonreserve international borrowing/lending balance becomes more positive (or less negative). d. The GDP Price Index and net nonreserve international borrowing/lending balance remain the same. e. There is not enough information to determine what happens to these two macroeconomic variables.

During the late 19th century, the U.S. price level fell. This unexpected increase in the real cost of borrowing caused wealth to be redistributed from _____ to _____

Fill in the blank(s) with correct word

In comparing money to a U.S. Treasury bond held by an individual, we can say:

A. money is an asset but the U.S. bond is a liability of the individual. B. money is a store of value but the bond is not. C. the treasury bond is an asset but money is not. D. both are stores of value.

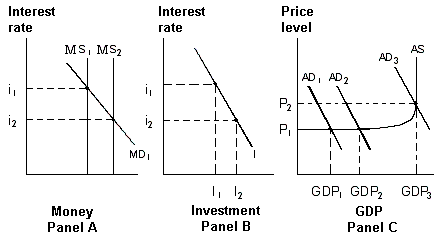

Exhibit 20-5 Money, investment and product markets

?

A. increase, and aggregate demand will shift from AD1 to AD2. B. decrease, and aggregate demand will shift from AD2 to AD1. C. remain the same, and aggregate demand will shift from AD2 to AD3. D. increase, and aggregate demand will shift from AD2 to AD1.