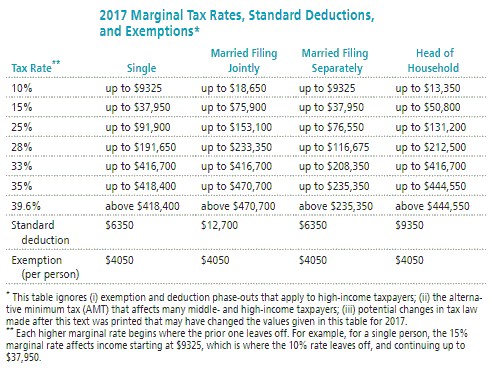

Solve the problem. Refer to the table if necessary. Your deductible expenditures are $9135 for interest on a home mortgage, $3722 for contributions to charity, and $579 for state income taxes. Your filing status entitles you to a standard deduction of $12,700. Should you itemize your deductions rather than claiming the standard deduction? If so, what is the difference?

Your deductible expenditures are $9135 for interest on a home mortgage, $3722 for contributions to charity, and $579 for state income taxes. Your filing status entitles you to a standard deduction of $12,700. Should you itemize your deductions rather than claiming the standard deduction? If so, what is the difference?

A. Yes, $736

B. Yes, -$422

C. No, you are better off with the standard deduction.

D. Yes, $26,136

Answer: A

You might also like to view...

Solve the problem.Anna deposits $2500 in a savings account that compounds interest annually at an APR of 6% . Dave deposits $2600 in a savings account that compounds interest daily at an APR of 5.6%. After 10 years, who has more in their savings account and how much more do they have?

A. Dave has $104.82 more than Anna. B. Anna has $175.26 more than Dave. C. Anna has $88.14 more than Dave. D. Dave has $74.43 more than Anna.

Write the first five terms of the geometric sequence with the given first term a and common ratio r.a = 4; r = 5

A. 4, 9, 14, 19, 24 B. 20, 100, 500, 2500, 12,500 C. 5, 20, 80, 320, 1280 D. 4, 20, 100, 500, 2500

At the beginning of 2017, Lisa Co. issued bonds with a face value of $700,000 due on December 31, 2023. The company desires to accumulate a fund to retire these bonds at maturity by making equal annual deposits beginning on December 31, 2017. ? Required: ? Compute the amount that the company must deposit at the end of each year, assuming that the fund will earn 10% interest a year compounded annually and seven deposits are made.

What will be an ideal response?

Sara contracted rubella (German measles) in the eleventh week of her pregnancy. Emily contracted rubella during the thirtieth week of her pregnancy. The difference in the way rubella would affect an unborn child at these two times is an example of which of the following?

A. continuous change B. discontinuous change C. a critical period D. a sensitive period