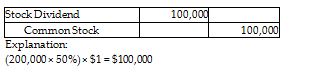

On December 1, 2018, Garland, Inc. had 200,000 shares of $1 par value common stock issued and outstanding. The next day, Garland declared and distributed a 50% stock dividend. The market value of the stock on December 2, 2018 was $9 per share. Prepare the journal entry for the transaction. Omit explanation.

What will be an ideal response?

You might also like to view...

Which of the following is not one of management's responsibilities?

a. Ensuring accounting principles are following in preparing financial statements. b. Engaging a qualified auditor. c. Implementing effective internal controls. d. Ensuring financial statements and disclosures are accurate.

Singer and McMann are partners in a business. Singer's original capital was $40,000 and McMann's was $60,000. They agree to salaries of $12,000 and $18,000 for Singer and McMann respectively and 10% interest on original capital. If they agree to share remaining profits and losses on a 3:2 ratio, what will Singer's share of the income be if the income for the year was $15,000?

A) $9,000 B) $2,400 C) $1,000 D) $5,600

Which of the following organizations is primarily responsible for establishing GAAP in the United States?

A) Securities and Exchange Commission (SEC) B) Financial Accounting Standards Board (FASB) C) International Accounting Standards Board (IASB) D) Internal Revenue Service (IRS)

Answers and interrogatories are made under the penalty of perjury

a. True b. False