One reason consumers were able to assume an increasing amount of household debt during the 2000s is because:

A. interest rates were so low that it made borrowing easier.

B. even though interest rates were high, the inflated values of homes allowed them to afford it.

C. interest rates were so low that people found it very easy to save their extra income.

D. even though interest rates were high, the herd instinct gave people a false confidence in their future wealth.

A. interest rates were so low that it made borrowing easier.

You might also like to view...

What happens to a country's production possibility frontier if it experiences a natural disaster such as a hurricane or an earthquake? Explain

What will be an ideal response?

Which of the following statements is FALSE about the long-run effects of outsourcing?

A) Outsourcing allows countries to specialize in producing what they can produce most efficiently. B) More goods and services can be produced than in the absence of outsourcing. C) Globally wages will increase because of outsourcing. D) Employment levels will decrease globally as the result of outsourcing.

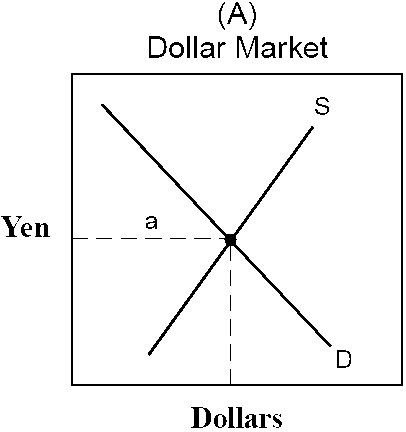

Figure 18-3

displays the international currency market for yen in terms of dollars and dollars in terms of yen. The supply curve in graph (A) is comprised of

a.

U.S. citizens attempting to purchase Japanese-made goods.

b.

Japanese attempting to purchase U.S.-made goods.

c.

U.S. businesses attempting to sell to the Japanese.

d.

Japanese businesses attempting to sell to the U.S.

e.

the U.S. government attempting to unload dollars to the international market.

When the nominal exchange changes from 120 yen per dollar to 110 yen per dollar, the dollar has:

A. become undervalued. B. appreciated. C. become overvalued. D. depreciated.