In the foreign exchange market, how will each of the following influences affect the demand for dollars and the demand curve for dollars?

a. an increase in the exchange rate

b. an increase in the U.S. interest rate

c. a fall in the expected future exchange rate

a. The increase in the exchange rate decreases the quantity of dollars demanded and creates an upward movement along the demand curve for dollars.

b. An increase in the U.S. interest rate increases the demand for dollars and shifts the demand curve for dollars rightward.

c. A fall in the expected future exchange rate decreases the demand for dollars and shifts the demand curve for dollars leftward.

You might also like to view...

Of all the money spent on farm price supports, about ______ percent goes to large corporate farms.

A. 25 B. 50 C. 75 D. 95

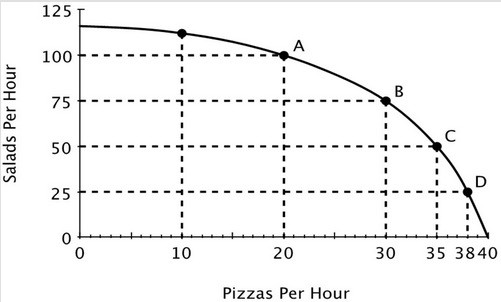

Refer to the accompanying figure. The opportunity cost of making an additional salad:

A. decreases as the number of pizzas decreases. B. remains constant regardless of how many salads are made. C. decreases as the number of salads increases. D. increases as the number of salads increases.

The economy in the period 1950 to 1998 behaved differently than the economy in the 1870 to 1940 time period. Economists explain this difference

A. in part because of the use of stabilization policy. B. because of increases in U.S. population due to the “baby boom.” C. in part because of the globalization of the economy. D. in part because of the use of competition policy.

Edith is buying products X and Y with her money income. Suppose her budget line shifts rightward (outward). This might be the result of:

A. the prices of X and Y increasing while her money income remains constant. B. her money income decreasing while the prices of X and Y remain constant. C. her money income increasing more than proportionately to increases in the prices of X and Y. D. none of these.