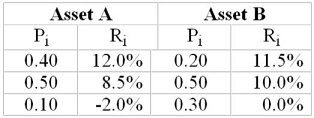

Consider the following two assets with probability of return = Pi and return = Ri. Calculate the expected return for each and the standard deviation. Which one carries the greatest risk? Why?

What will be an ideal response?

For asset A, the expected return = 0.4(12) + 0.5 (8.5) + 0.1(-2.0) = 8.85%

For asset B, the expected return = 0.2(11.5) + 0.5(10.0) + 0.3(0) = 7.30%

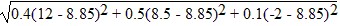

For asset A, the standard deviation is 3.98 =

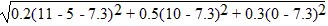

For asset B, the standard deviation is 4.81 =

Since asset B has a higher standard deviation than asset A, its return has higher risk.

You might also like to view...

A textile manufacturing unit faces low productivity due to shirking by workers. Which of the following is a possible solution to increase productivity and retain employees?

A) The provision of a lower real wage B) The provision of a lower nominal wage C) The provision of minimum wages D) The provision of efficiency wages

The set of skills, knowledge, and personal attributes possessed by a superior performer are known as

a. clusters b. mindsets c. competencies d. components

People can borrow and lend money to smooth out short term variations in income known as what kind of changes?

Post 9/11, air travel industry in the U.S. economy saw an increase in demand, which led to a sharp rise in employment opportunities

Indicate whether the statement is true or false