Who bears the burden of the government debt? Explain why. Under what circumstances is there no burden to be borne?

What will be an ideal response?

If taxes must be raised in the future to pay off the debt, the distortions from higher tax rates are a burden on future generations. Also, if bondholders are on average wealthier than taxpayers, there will be a redistribution of wealth as the debt is repaid. Finally, if the debt reduces national saving, then investment will be lower, which reduces the capital stock, which means a lower standard of living for future generations. But if taxes are lump-sum and Ricardian equivalence holds, there is no burden, since then private saving rises to prevent the debt from having any effects on national saving.

You might also like to view...

A change in ________ creates a movement along the aggregate demand curve but does not shift the aggregate demand curve

A) tax rates B) the price level C) fiscal policy D) None of the above because they all shift the aggregate demand curve.

Suppose the point (Q = 3,400, P = $20) is the midpoint on a certain downward-sloping, linear demand curve. Then

a. a decrease in price from $18 to $16 will increase total revenue. b. a decrease in price from $24 to $22 will decrease total revenue. c. a decrease in the price from $21 to $19 will decrease total revenue. d. the maximum value of total revenue is $68,000.

Labor markets are different from most other markets because labor demand is

a. unresponsive to changes in wages. b. unresponsive to changes in the final prices of the products produced by the labor. c. a derived demand. d. very responsive to labor supply.

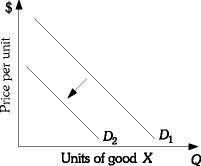

Refer to the information provided in Figure 3.3 below to answer the question(s) that follow. Figure 3.3Refer to Figure 3.3. As your income decreased, the demand for X shifted from D1 to D2. Good X is

Figure 3.3Refer to Figure 3.3. As your income decreased, the demand for X shifted from D1 to D2. Good X is

A. an inferior good. B. a luxury good. C. an income-neutral good. D. a normal good.