Suppose you purchase a $1,000 bond that bears an interest rate of 10 percent. What will happen if the interest rate goes to 20 percent?

A. The market price of the bond will increase to $2,000.

B. The market price of the bond will drop to $500.

C. The return on the bond will double.

D. The return on the bond will halve.

Answer: B

You might also like to view...

The additional costs you expect to incur if you undertake an activity and the additional benefits you expect to receive if you undertake an activity are called ________ costs and benefits

Fill in the blank(s) with correct word

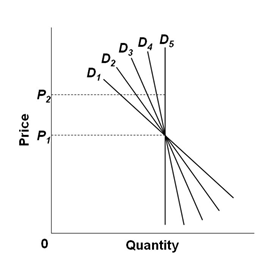

Figure 5-6

A. the price of wine coolers has risen. B. income has increased. C. the price of beer has fallen. D. the price of wine coolers has fallen. E. All of the responses are correct.

Assume that the Fed lowers the required reserve ratio. How will this affect the money supply?

a. It would decrease. b. It would increase. c. It would remain unchanged. d. It depends on the value of interest rates.

Refer to the graph below. Which demand curve is relatively most elastic between P1 and P2?

A. D1

B. D2

C. D3

D. D4