As long as a consumer remains on the same indifference curve,

a. she is indifferent to all points that lie on any other indifference curve.

b. her preferences will not affect the marginal rate of substitution.

c. she is unable to decide which bundle of goods to choose.

d. she is indifferent among the points on that curve.

d

You might also like to view...

What role do households play in capital markets?

What will be an ideal response?

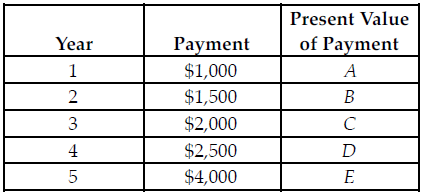

Refer to the table below. What is the value of A plus B plus C plus D (A + B + C + D) or the present value of the first four payments?

The above table shows a 5 year payment plan. Each payment is made at the end of the year, so after one year, a payment of $1,000 is made, after two years another payment of $1,500 is made and so on. The interest rate is 3 percent.

A) $6,200.50

B) $6,225.32

C) $6,436.27

D) $6,589.23

A market with many sellers, some influence over price, low barriers to entry, a differentiated product, and non-price competition often taking the form of advertising is known as

A) perfect competition. B) monopolistic competition. C) oligopoly. D) monopoly.

Consider the following four investors. Rank each according to who has the most to gain from investing in 30-year tax-exempt municipal bonds. Each investor has $1,000 in a savings account that he/she plans to use to buy bonds. Explain briefly why you ranked the investors this way.(a) A 20-year old college student who earns low income through working over summers and breaks. The student plans to graduate next year.(b) The CEO of a large company who is currently in the highest tax bracket.(c) A middle-income household saving up to move into a larger home.(d) A 60-year old nurse who plans to retire at age 62. He uses a tax-exempt pension fund for all of his savings.

What will be an ideal response?