What is the present value of an infinite stream of annual payments of $10,000 per year if the first payment is received one year from today? Assume the interest rate is 10 percent.

A. $100,000

B. $1,000,000

C. $10,000,000

D. $1,000,000,000

Answer: A

You might also like to view...

If the economy has an MPC of 0.8, by how much will a $50 billion increase in government purchases increase GDP? By how much will a $50 billion increase in taxes decrease GDP?

What will be an ideal response?

Management and a labor union are bargaining over how much of a $50 surplus to give to the union. The $50 is divisible up to one cent. The players have one shot to reach an agreement. Management has the ability to announce what it wants first, and then the labor union can accept or reject the offer. Both players get zero if the total amounts asked for exceed $50. If you were the labor union, which type of "rules of play" would you prefer to divide the $50 surplus?

A. One-shot, sequential-move game with management as the first mover B. One-shot, sequential-move game with labor union as the first mover C. One-shot, simultaneous-move game and one-shot, sequential-move game with management as the first mover D. One-shot, simultaneous-move game

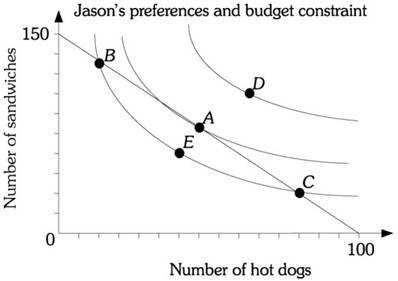

Refer to the information provided in Figure 6.15 below to answer the question that follows. Figure 6.15Refer to Figure 6.15. Why is Jason not maximizing his utility at point B?

Figure 6.15Refer to Figure 6.15. Why is Jason not maximizing his utility at point B?

A. His marginal utility per dollar spent on the last sandwich is less than his marginal utility per dollar spent on his last hot dog. B. His marginal utility per dollar spent on the last sandwich is greater than his marginal utility per dollar spent on his last hot dog. C. He is not spending his entire budget. D. He is maximizing his utility at point B.

Large cities typically have many drugstores that offer different levels of service and product selection. The drugstore market in big cities can best be classified as

A. Oligopoly. B. Monopoly. C. Monopolistic competition. D. A competitive market.