Which of the following types of mortgage loans became more common during the housing boom of the early-to-mid 2000s?

A) those with flawed credit histories

B) thirty-year, fixed-rate mortgages

C) prime Mortgages

D) those with down payments of at least 20%

A

You might also like to view...

When there is an expansionary gap, inflation will ________, in response to which the Federal Reserve will ________ real interest rates, and output will ________.

A. decline; lower; expand B. increase; raise; decline C. decline; lower; decline D. decline; raise; decline

Because of free riders, a private, unregulated market would not produce the efficient quantity of a public good

Indicate whether the statement is true or false

The real interest rate is the nominal interest rate plus the expected inflation rate.

Answer the following statement true (T) or false (F)

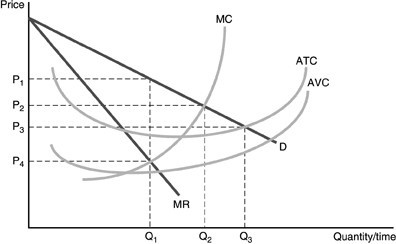

Refer to the above figure. Profits for this firm are

Refer to the above figure. Profits for this firm are

A. negative. B. zero. C. positive. D. undetermined without more information.