Explain the process by which the banking system creates money

What will be an ideal response?

When a bank gains excess reserves, it uses the excess reserves to make a loan. The person or a business receiving the loan receives a deposit—money! The borrower then generally spends the loan and it ends up as a deposit—money—in another company's account. That company's bank then gains some excess reserves, which it loans, and so more money is created. Thus the banking system creates money by making loans.

You might also like to view...

People have less incentive to invest the more concerned they are that their investment will not be

a. appropriated by government b. stolen by thieves c. protected from high tax rates d. destroyed by civil unrest e. blown up by terrorists

If the market interest rate decreases, then there will be _____

a. an upward movement along the investment demand curve b. a downward movement along the investment demand curve c. a rightward shift of the investment demand curve d. a leftward shift of the investment demand curve e. no movement along or shift of the investment demand curve

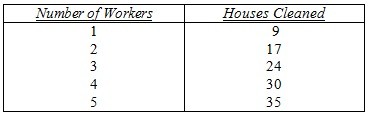

A housecleaning company receives $25 for each house cleaned. The table below gives the relation between the number of workers and the number of houses that can be cleaned per week.  Based on the above info, if the wage rate of a housecleaner is $130, what is the maximum amount of profit the company can earn?

Based on the above info, if the wage rate of a housecleaner is $130, what is the maximum amount of profit the company can earn?

A. $750 B. $230 C. $150 D. $ 20 E. none of the above

Suppose a German bank purchases a U.S. Treasury bond. This transaction would be recorded in the:

A. capital account. B. current account. C. goods trade balance. D. unilateral transfers.