One type of insurance rating law permits insurers to file their rates with regulatory authorities and to use the rates immediately. Regulators have the authority to disapprove the rates later under certain circumstances. This type of rating law is called a(n)

flex-rating law.

no filing required.

file-and-use law.

prior-approval law.

file-and-use law.

You might also like to view...

The employees of Fantasy Textiles are concerned about company management overlooking their interests. They decide to form a union to voice their concerns and speak up for their rights. They elect Gino to represent them during negotiations. Gino's new role requires him to ensure that the terms of the labor contract are enforced and that the interests of the union are met. In this context, Gino most likely holds the position of

A. chief executive officer. B. business representative. C. union trustee. D. union steward. E. stakeholder.

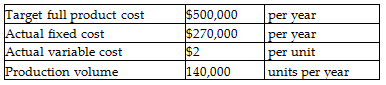

Actual costs are currently higher than target full product cost. Assume all products produced are sold. Assuming that variable costs are dependent on commodity prices and cannot be reduced, what is the target fixed cost?

Discourse Stationery Company is a price-taker and uses target pricing. The company has completed an analysis of its revenues, costs, and desired profits and has calculated its target full product cost. Refer to the following information:

A) $230,000

B) $280,000

C) $220,000

D) $500,000

Describe the three main marketing functions and give an example of each

What will be an ideal response?

Firms sometimes acquire debt securities with the intention of holding these securities until maturity. U.S. GAAP and IFRS require firms to measure marketable securities for which firms have an intent and ability to hold to maturity by _____. A firm initially records these debt securities at acquisition cost. This acquisition cost will differ from the maturity value of the debt if the coupon rate

on the bonds differs from the _____. a. the imputed interest method; required market yield on the bonds at the time the firm acquired them b. the straight-line method; required market yield on the bonds at the time the firm acquired them c. the effective interest method; required market yield on the bonds at the time the firm acquired them d. the effective interest method; required market yield on the bonds at the time the bonds were originally issued. e. the straight-line method; required market yield on the bonds at the time the bonds were originally issued.