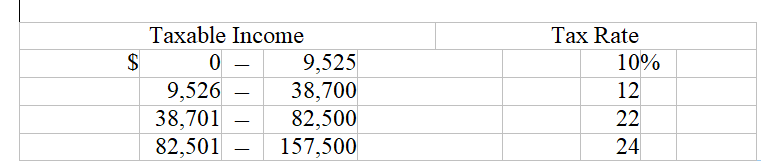

Given the personal income tax rates as shown, what is the average tax rate for an individual with taxable income of $118,700?

A) 24.00 percent

B) 22.36 percent

C) 19.00 percent

D) 21.94 percent

E) 21.00 percent

C) 19.00 percent

You might also like to view...

The strategic marketing planning process requires a careful assessment of market attractiveness and competitive position. Briefly describe what is involved in this assessment and identify three main factors for each

What will be an ideal response?

If the net present value is positive, the actual return on a project exceeds the required rate of return

Indicate whether the statement is true or false

For the problem below, what is the quantity assigned to the cell Source 3-Destination 1 using the intuitive method for an initial feasible solution?

A) 3 B) 13.333 C) 30 D) 45 E) 50

Felicia had just taken over her family's business after spending ten years in the marketing department of a large corporation. She met with a representative from one of her firm's biggest customers, who told her, "We should think about how we can make the pie bigger rather than fighting over the size of the slices." She had expected a more cutthroat approach rather than this call for a

A. partnering relationship. B. common marketing system. C. shared mission statement. D. linked supply chain. E. corporate vertical marketing system.