Residential mortgages historically carried a capital requirement of 4 percent. Why did these mortgages, bundled as part of the mortgage-backed securities issued by investment banks, turn out to be far more risky than historically indicated?

a. Rating agencies miscalculated the historical risk of traditional fixed-rate residential mortgages.

b. Investment banks leveraged these mortgage-backed securities more than was allowable under SEC rules.

c. Lower mortgage lending standards increased the likelihood that defaults would occur.

d. Investment banks held too much capital relative to these mortgage-backed securities.

C

You might also like to view...

Under TANF, the time limit for receiving benefits during a lifetime is

A. 12 years. B. 13 weeks. C. 60 months. D. 5 months.

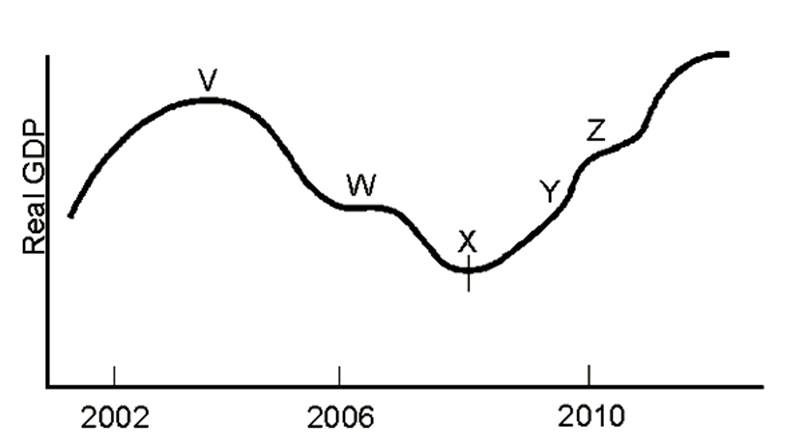

A trough occurs at point

A. V.

B. W.

C. X.

D. Y.

If people attempt to sell bonds because of excess money demand, then the interest rate will:

a. rise. b. fall. c. remain unchanged d. react unpredictably.

If we observe a great deal more advertising for Mucinex, an over-the-counter drug, than for a Grainger drill press, we can infer that

a. more money is spent on Mucinex than on Grainger drill presses. b. the market for Mucinex is more highly differentiated than the market for Grainger drill presses. c. Grainger has lower costs of production than Mucinex. d. Mucinex operates in an oligopoly, while Grainger operates in a monopolistically competitive market.