Which of the following conclusions is not supported by the Three-Sector-Model?

a. A decrease in borrowing demand causes the real risk-free interest rate to fall and equilibrium quantity of real loanable funds to rise.

b. An increase in the supply of a nation's real loanable funds reduces the real risk-free interest rate and increases the equilibrium quantity of real loanable funds.

c. An increase in a nation's demand for goods and services within the intermediate range results in an increase in the real GDP and a higher GDP Price Index.

d. An increase in the value of a nation's currency encourages domestic imports and discourages exports.

e. All of the above are supported by the Three-Sector Model.

.A

You might also like to view...

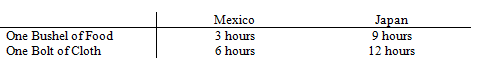

Refer to Mexico and Japan. What is the cost of producing 1 bolt of clothing in Mexico?

a. 6 hours of labor.

b. 2 bushels of food.

c. 3 bushels of imported Japanese food.

d. 4 bolts of imported Japanese cloth.

A firm in monopolistic competition that is maximizing profit ________

A. always makes a positive economic profit in the short run B. never needs to shut down because its price always exceeds minimum average variable cost C. might, in the short run, sell at a price that is less than average total cost D. shuts down temporarily if it incurs a loss equal to total variable cost

A monopolist maximizes profit by producing an output level where marginal cost equals price

a. True b. False Indicate whether the statement is true or false

Aggregate demand decreases and real output falls, but the price level remains the same. Which factor most likely contributes to downward price inflexibility?

A. The wealth effect. B. Business taxes. C. Fear of price wars. D. The multiplier effect.