Explain why the two parties in a futures contract technically do not make a bilateral agreement with each other.

What will be an ideal response?

With a futures contract, the high degree of standardization allows for the use of a clearing corporation. Of the many roles the clearing corporation performs, one is to be the actual counterparty. The two parties to a futures contract make an agreement with the clearing corporation which acts like an insurance company, guaranteeing that both parties will meet their obligations. This increases the efficiency and use of futures contracts.

You might also like to view...

How many and what fraction of the world's people live in advanced economies? In emerging market and developing economies?

What will be an ideal response?

If product price increases, then:

a. MP will increase. b. MFC will increase. c. MRP will increase. d. MP will decrease.

When government imposes a price ceiling or a price floor on a market,

a. price no longer serves as a rationing device. b. efficiency in the market is enhanced. c. shortages and surpluses are eliminated. d. both buyers and sellers become better off.

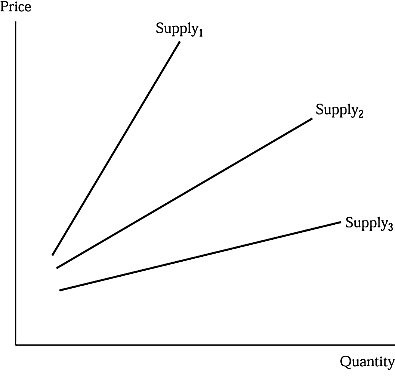

In Figure 4.3, the most inelastic supply curve:

In Figure 4.3, the most inelastic supply curve:

A. is Supply1. B. is Supply2. C. is Supply3. D. cannot be determined.