Suppose the nominal yield on interest rates during the next two years was expected to remain at 10%, but the yield on a one-year security was 10% and on two-year securities was 8%. Investors would:

a. Borrow for one year, invest for two years, and, at the end of the first year, roll over the loan.

b. Probably do nothing, because markets are efficient, which means there is no way to arbitrage the markets.

c. Borrow for two years, invest for one year, and then roll over the investment at the end of the first year.

d. Borrow for two years and invest for two years, but at the end of the first year, re-borrow and re-invest at the market rate.

e. Borrow for one year and invest for one year, but at the end of the first year, re-borrow and re-invest the borrowed funds at the expected rate.

.C

You might also like to view...

The price per unit times the total quantity sold is

A) average revenue. B) marginal revenue. C) total revenue. D) price revenue.

Protectionism ensures fair trade by: a. restricting imports

b. reducing the prices of domestic products. c. encouraging the import of low-priced products. d. creating more jobs in export industries.

You have gone to the bank to borrow money for one year. The nominal annual interest rate is 7.5%. The real rate of interest is 4%. Over the course of the year, overall prices increased by 4%. This rate of inflation hurt the _____ because the actual rate of inflation was _____ than the anticipated rate of inflation.

Fill in the blank(s) with the appropriate word(s).

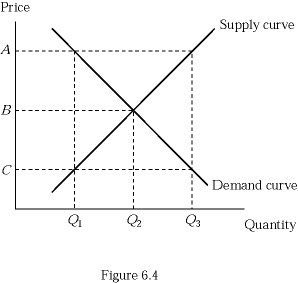

Refer to Figure 6.4. If a market experiences excess supply and fails to maximize total surplus, a minimum price must have been set at:

Refer to Figure 6.4. If a market experiences excess supply and fails to maximize total surplus, a minimum price must have been set at:

A. A. B. B. C. C. D. There is not sufficient information.