Under IFRS, deferred tax assets:

A. are not recognized.

B. are recognized only to the extent it is deemed probable that they will be realized.

C. are reported as current or noncurrent based on the expected date of the reversal of the temporary difference.

D. require a valuation allowance if it's more likely than not that the deferred tax asset will not be realized.

Answer: B

You might also like to view...

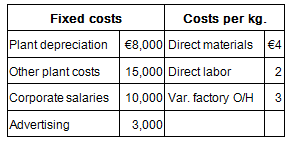

Calculate the operating income for August using variable costing.

Lilypad Hot Tubs, Inc. reports the following information for August:

![]()

A) $380,000

B) $577,000

C) $307,000

D) $650,000

Which of the following statements is FALSE?

A) Increasing the pay-for-performance sensitivity comes with the added benefit of reducing managers' risk. B) Stock and option grants give managers a direct incentive to increase the stock price to make their stock or options as valuable as possible. C) By tying compensation to performance, the shareholders effectively give the manager an ownership stake in the firm. D) During the 1990s, most companies adopted compensation policies that more directly gave managers an ownership stake by including grants of stock or stock options to executives.

The ratio of MSE/MSR yields

a. SST b. the F statistic c. SSR d. None of these alternatives is correct.

Francois French manufactures cheese, which he normally sells at €20/kg, on which sales commission of 5% is paid. Plant capacity is 7,500 kg/month. Income tax is levied at 30%.

If sales are 5,000 kgs, which of the following is true?

A. Total contribution margin is €50,000

B. Ratio of total contribution margin to net income before taxes is 3.57

C. Taxes payable are €4,200

D. Operating leverage is 42%

E. All of the above