If both borrowers and lenders become discouraged by difficult-to-predict inflation:

A. it will become more difficult for financial intermediation to generate and coordinate savings with investment.

B. the excess supply of loanable funds will drive real interest rates higher and higher.

C. the velocity of money will increase, leading to higher unemployment and lower real GDP.

D. the federal reserve will have to respond by sharply increasing the money supply.

Ans: A. it will become more difficult for financial intermediation to generate and coordinate savings with investment.

You might also like to view...

Which of the following statements is TRUE?

A) APC + APS = 1 B) APC + APS < 1 C) APC + MPS = 1 D) APC + APS + MPC + MPS = 1

Temporary Assistance to Needy Families is a government program with the goal of:

A. redistribution. B. economic growth. C. social insurance. D. None of these is true.

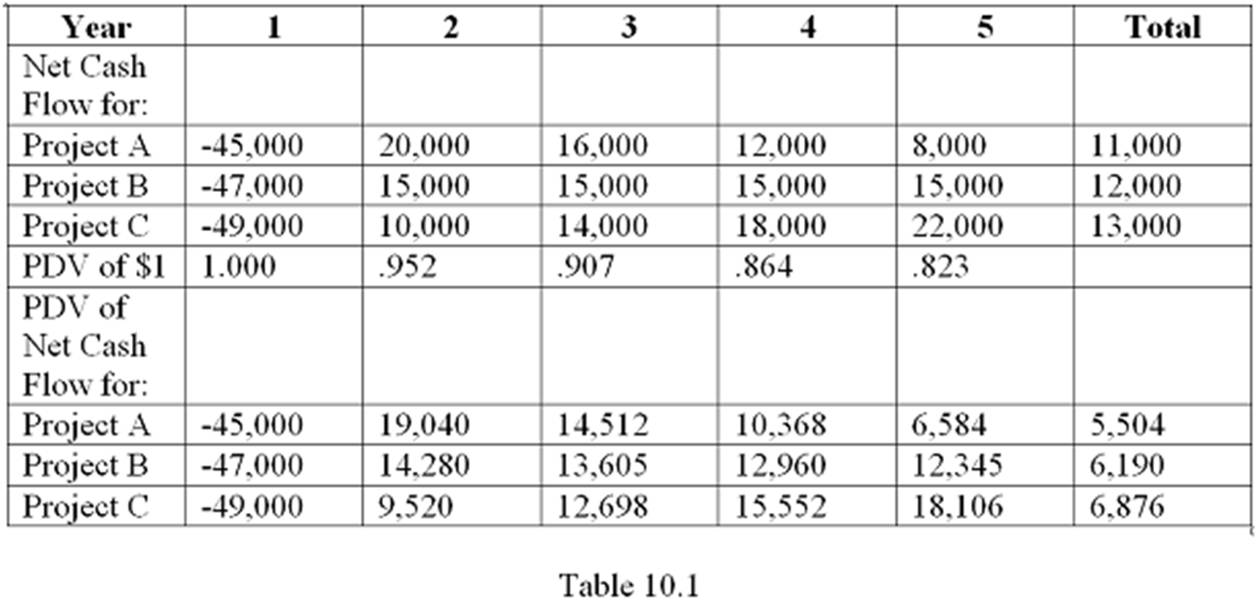

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company. Assume an interest rate of 5%. Which project has the highest NPV?

A. Project A

B. Project B

C. Project C

D. It cannot be determined from the information given.

The theoretical model of the intertemporal budget constraint suggests that the most important factor in support of individual savings is:

a. the preference of the individual. b. a higher rate of return on savings. c. an increase in income. d. a decrease in the cost of living.