The income tax is:

A. an automatic stabilizer because income tax revenues fall as income increases, accelerating an economic expansion.

B. an automatic stabilizer because income tax revenues rise as income increases, slowing an economic expansion.

C. not an automatic stabilizer.

D. an automatic stabilizer because income tax revenues rise as income increases, accelerating an economic expansion.

Answer: B

You might also like to view...

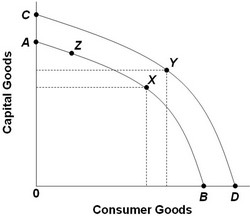

Use the figure below to answer the next question. The most likely cause of a shift from AB to CD would be a(n)

The most likely cause of a shift from AB to CD would be a(n)

A. recession. B. increase in the price level. C. increase in productivity. D. decrease in the size of the labor force.

As a plaintiff, all of the following will help you negotiate a larger settlement except which one?

A) increasing the defendant's estimate of damages B) decreasing the defendant's estimate of damages C) increasing the defendant's cost of litigation D) raising the defendant's subjective probability that you will win

If the price elasticity of demand for a good is 0.45, it is most likely that the good

a. has many close substitutes b. is a luxury good c. is high-priced d. is a complementary good e. has a demand curve that is price inelastic

Suppose Bev's Bags makes large handbags and small handbags. They sold 70,000 large bags for $45 each and 25,000 small bags for $15 each. If the company had total costs of $2,000,000, what was the profit for this company?

A. $375,000 B. $3,525,000 C. $1,525,000 D. $850,000