Holding liquidity and default risk constant, an investor earning 6% from a tax-exempt bond who is in a 25% tax bracket would be indifferent between that bond and a taxable bond with a(n):

A. 7.5% yield.

B. 6.25% yield.

C. 8% yield.

D. 4.5% yield.

Answer: C

You might also like to view...

Which is FALSE about perfect competition?

A) There are numerous sellers. B) Market entry and exit is unrestricted. C) There is no ability to set price. D) There is considerable product differentiation.

A trade deficit occurs when:

a. a country imposes a price floor on the good in which it has a comparative advantage. b. a country's imports exceed its exports. c. a country imposes a price ceiling on the good in which it has a comparative advantage. d. a country's exports exceed its imports. e. the domestic product market is in disequilibrium.

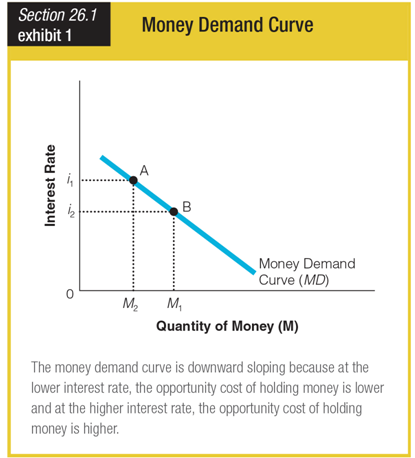

Movement from point A to point B illustrates which of the following?

a. a decrease in the quantity of money demanded

b. an increase in the quantity of money demanded

c. a stabilization of the opportunity cost of holding money

d. an increase in the opportunity cost of holding money

A firm has average fixed costs of $0.20 and average variable costs of $2.50 at an output of 500 units. The firm's total costs are therefore

A. $1,150. B. $1,350. C. $1,250. D. $1,500.