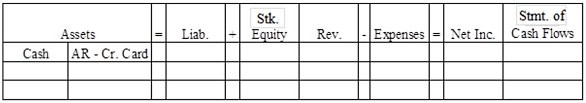

Green Acres Lawn Care provided $600,000 of services to customers during Year 1. All customers paid for the services with credit cards. The company submitted the credit card receipts to the credit card company immediately, and the credit card company paid cash in the amount of face value less a 4 percent service charge.Required:Record the (1) credit card sales and (2) collection of the receivables in the horizontal statements model, below. Show dollar amounts of increases and decreases. For cash flows, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Use NA to indicate that an element is not affected by an event.

height="103" width="586" />

What will be an ideal response?

(1) The credit card sale increases total assets (accounts receivable-credit card company) by $567,000 [or $600,000 ? ($600,000 × 4%)]. It increases revenue by $600,000 and increases expenses (credit card expense) by $24,000 (or $600,000 × 4%).

(2) The collection from the credit card company increases assets (cash) by $576,000 and decrease assets (accounts receivable-credit card company) by the same amount.

You might also like to view...

Over the life of the firm, the present value of ______________________________, ______________________________, and ____________________ will be the same

Fill in the blank(s) with correct word

Dees’ Spectrum of Organizations classifies organizations that use only volunteers as a workforce as purely ______.

A. public B. charitable C. commercial D. philanthropic

What is a sales territory?

What will be an ideal response?

Mays Industries was established in 2013. Since its inception, the company has generated the following levels of taxable income (EBT): YearTaxable Income2013$50,0002014$40,0002015$30,0002016$20,0002017-$52,5002018$60,000? Assume that each year the company has faced a 40% income tax rate. Also, assume that the company has taken full advantage of the Tax Code's carry-back, carry-forward provisions, and assume that the current provisions were applicable in 2013. What is the company's tax liability for 2018?

A. $19,780 B. $27,830 C. $23,000 D. $25,990 E. $17,250