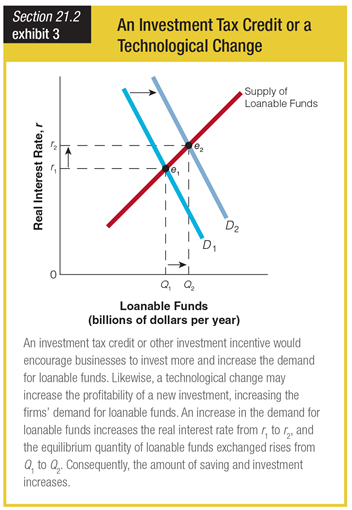

Based on the graph showing the effects of an investment tax credit or a technological change, enacting an investment tax credit would ______.

a. create a negative real interest rate

b. have little or no effect on the real interest rate

c. increase the real interest rate

d. decrease the real interest rate

c. increase the real interest rate

You might also like to view...

Why does an increase in the supply of computers lead to a lower price for a computer?

What will be an ideal response?

All else equal, when a monopolist increases its price, revenue will fall because of the lost sales

a. True b. False

Suppose Jones sells a good for $100 at a yard sale. If the producer surplus from the sale is $75, Jones's cost of the good must have been:

a. $100 b. $175. c. $25 d. equal to the deadweight loss.

The proposition that an increase in the federal budget deficit caused entirely by a current tax cut has no effect on aggregate demand is called the

A) Ricardian equivalence theorem. B) interest rate effect. C) indirect effect. D) open-economy effect.