Compute the expected return, standard deviation, and value at risk for each of the following investments:Investment (A): Pays $800 three-fourths of the time and a $1,200 loss otherwise.Investment (B): Pays $1,000 loss half of the time and a $1,600 gain otherwise.State which investment will be preferred by each of the following investors, and explain why.(i) a risk-neutral investor(ii) an investor who seeks to avoid the worst-case scenario.(iii) a risk-averse investor.

What will be an ideal response?

Investment (A)

Expected return = 0.25(-$1,200) + 0.75($800) = $300

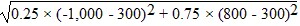

Standard Deviation =  =

=  = 866

= 866

Value at Risk = -$1,200

Investment (B)

Expected return = 0.5(-$1,000) + 0.5($2,000) = $500

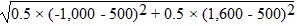

Standard Deviation =  =

=  = 1,300

= 1,300

Value at Risk = -$1,000

(i) The risk-neutral investor is indifferent between these two investments because they pay the same expected return.

(ii) The investor who seeks to avoid the worst-case scenario will choose Investment (B) because it has the lower value at risk.

(iii) The risk-averse investor will prefer Investment (A) because it has a lower standard deviation. This suggests that there is less uncertainty about the expected return relative to Investment (B).

You might also like to view...

Expansionary monetary policy should initially change gross investment by ________.

A. more than necessary to reach full employment B. an amount determined by the money multiplier C. enough to reach full employment D. less than necessary to reach full employment

The percentage of people living in urban areas decreased surprisingly between 1860 and 1910

Indicate whether the statement is true or false

Entrepreneurs seek accounting profit

Indicate whether the statement is true or false

If a price ceiling is not binding, then

a. the equilibrium price is above the price ceiling. b. the equilibrium price is below the price ceiling. c. it has no legal enforcement mechanism. d. None of the above is correct because all price ceilings must be binding.