What are a firm's two principal sources of financing? Of what do these sources consist?

What will be an ideal response?

The total assets represent the resources owned by the firm, and total liabilities and total shareholders' equity indicate

how those resources were financed. Debt is money that has been borrowed and must be repaid at some predetermined

date to the creditors. Equity represents the shareholders' (owners') investmentNboth preferred stockholders and

common stockholdersNin the firm.

Preferred stockholders generally receive a dividend that is fixed in amount. In the event of the firm being liquidated,

these stockholders are paid after the firm's creditors but before the common stockholders. Common stockholders are the

residual owners of a business. They receive whatever income is left over after paying all expenses. In the event the firm

is liquidated, the common stockholders receive only what is left overNgood or badNafter the creditors and preferred

stockholders are paid. The amount of a firm's common equity is equal to the sum of two items: 1. the amount a

company receives from selling its stock to investors, and 2. profits retained within the business.

You might also like to view...

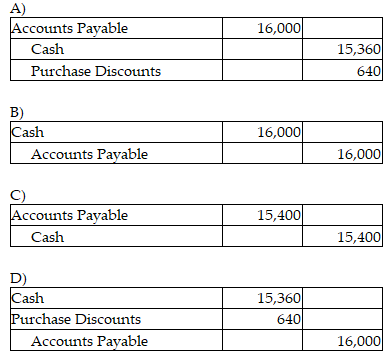

Dublin, Inc. uses the periodic inventory system. On February 1, the corporation purchased inventory on account for $16,000. The terms were 4/10, n/30. On February 2, it returned damaged goods worth $600 to the supplier. Give the journal entry for the payment if the invoice is paid after the discount period. (Round your answers to the nearest dollar.)

The purpose of the purchase order is to

a. order goods from vendors b. record receipt of goods from vendors c. authorize the purchasing department to order goods d. approve payment for goods received

Sweet Company's outstanding stock consists of 1800 shares of cumulative 4% preferred stock with a $100 par value and 10,800 shares of common stock with a $10 par value. During the first three years of operation, the corporation declared and paid the following total cash dividends. Dividends Declared & PaidYear 1$2800?Year 2$6800?Year 3$36,000?The total amount of dividends paid to preferred and common shareholders over the three-year period is:

A. $17,200 preferred; $28,400 common. B. $14,400 preferred; $31,200 common. C. $21,600 preferred; $24,000 common. D. $14,000 preferred; $31,600 common. E. $7200 preferred; $38,400 common.

Deciding the key message of a speech is what step in the speech preparation process?

a. Determining the general purpose b. Analyzing the audience c. Planning how to get out of the speech assignment d. Organizing the speech e. Identifying the central idea