Explain the distinction between investment and capital

Investment is the flow of resources into the production of new capital; it is the process of construction of new plant and equipment during some period of time. Capital is the stock of plant, equipment, and other productive resources created in the investment process. Capital is measured at a moment in time and is increased when net new investment occurs. The key distinction is that capital is a stock, while investment is a flow. Capital is measured as a certain amount as of a particular date, while investment is measured as a certain amount per time period.

You might also like to view...

From any point above the current LM curve, money market equilibrium can be restored by some combination of a ________ income and a ________ interest rate

A) higher, higher B) higher, lower C) lower, higher D) lower, lower

The secondary mortgage market is the market

a. designated specifically for prime and other low risk mortgages. b. designated specifically for sub-prime and other high risk mortgages. c. where mortgages originated by a lender are sold to another financial institution. d. where home purchasers borrow funds from mortgage originators.

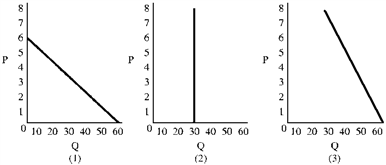

Figure 5-3

Assume the market consists of three consumers with the demand curves in Figure 5-3. At a price of 1, the total market demand is

a.

40.

b.

80.

c.

140.

d.

150.

When determining the production possibilities curve

A. the amount of productive resources remains constant. B. the prices of resources are used. C. the prices of the goods are used. D. the trade-off between the goods in the economy remains constant.