One asset has a beta of 1.5 and another asset has a beta of 0.75. The difference in beta mean that the asset with a beta of 0.75 has:

A. 75 percent less nondiversifiable risk than the asset with a beta of 1.5

B. 75 percent more nondiversifiable risk than the asset with a beta of 1.5

C. Twice as much nondiversifiable risk as the asset with a beta of 1.5

D. One-half of the nondiversifiable risk of the asset with a beta of 1.5

D. One-half of the nondiversifiable risk of the asset with a beta of 1.5

You might also like to view...

Refer to the scenario above. What is the total cost involved if Maria chooses to travel by train?

A) $60 B) $400 C) $420 D) $460

Which of the following statements about markets and industries is TRUE?

A.A market includes buyers but not sellers. B. An industry includes buyers but not sellers. C.A market includes sellers but not buyers. D. An industry includes sellers but not buyers.

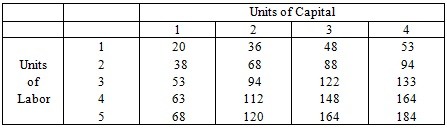

Use the following table to answer the question below: The amount of total output produced from various combinations of labor and capital.  If capital is fixed at three units, how much does the fourth unit of labor add to total output?

If capital is fixed at three units, how much does the fourth unit of labor add to total output?

A. 16 B. 28 C. 36 D. 34 E. none of the above

Exhibit 3A-1 Comparison of Market Efficiency and Deadweight Loss

A. ADFB. B. CEFD. C. EGH. D. BEF.