The marginal tax rate shows

A) the percentage of income which a typical family pays in tax.

B) the average rate of taxation in the economy.

C) the deductions which are permitted for child care and medical expenses.

D) the extra tax due on an extra dollar of income.

Answer: D

You might also like to view...

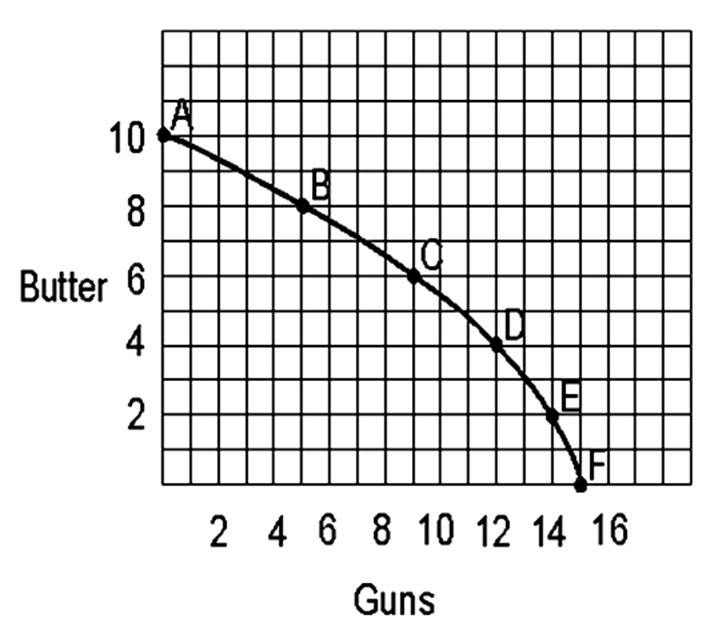

A country producing a combination of 5 units of guns and 6 units of butter would be _________________ (outside/on/inside) the production possibilities curve

What will be an ideal response?

Which of the following is correct?

a. Keynesians believe there is an indirect link between changes in a nation's money supply and changes in expenditures. b. Monetarists believe there is an indirect link between changes in a nation's money supply and changes in expenditures. c. Keynesians believe there is a direct link between changes in a nation's money supply and changes in expenditures. d. Monetarists believe there is no short-term link between changes in a nation's money supply and changes in expenditures. e. Keynesians believe there is no short-term link between changes in a nation's money supply and changes in expenditures.

Some people see the government as being more heavily involved in taking sides than in serving the common interest

Indicate whether the statement is true or false

(1)(2)(3)(4)(5)QdQdPriceQsQs5040$1070806050960708060850609070740501008063040Refer to the above table. In relation to column (3), a change from column (4) to column (5) would most likely be caused by:

A. government placing an excise tax on the good. B. an increase in consumer income. C. an improvement in production technology. D. an increase in input prices.