Solve the problem.Mai earns a gross weekly income of $372.00. How much Social Security tax should be withheld the first week of the year? How much Medicare tax should be withheld? Social security tax is 6.2% and Medicare tax is 1.45%. Round to the nearest cent.

A. Social Security tax = $23.06

Medicare tax = $5.39

B. Social Security tax = $2.31

Medicare tax = $0.54

C. Social Security tax = $24.06

Medicare tax = $6.39

D. Social Security tax = $230.60

Medicare tax = $53.90

Answer: A

Mathematics

You might also like to view...

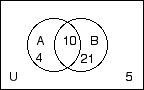

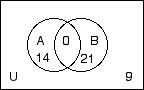

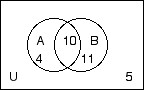

Draw an appropriate Venn diagram and use the given information to fill in the number of elements in each region.n(A) = 14, n(B) = 21, n(A ? B) = 25, n(B') = 9

A.

B.

C.

D.

Mathematics

Determine if the set is the empty set.{x|x is a number less than 4 or greater than 8}

A. Yes, it is the empty set. B. No, it is not the empty set.

Mathematics

Find the value of the rational expression for the given value. Make sure your fi nal answer is simplified completely. ; x = -9

; x = -9

A.

B.

C.

D.

Mathematics

Evaluate.70 - 150

A. -8 B. 0 C. 2 D. 1

Mathematics