Which of the following is not a goal of government programs?

a. to enforce private property rights

b. to prohibit natural monopolies

c. to reduce pollution

d. to transfer money from higher-income households to the poorest households

e. to maintain price stability

B

You might also like to view...

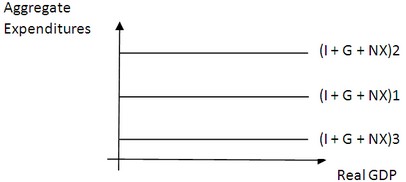

Use the following diagram to answer the next question. All else equal, which of the following events would cause a shift from (I + G + NX)1 to (I + G + NX)2?

All else equal, which of the following events would cause a shift from (I + G + NX)1 to (I + G + NX)2?

A. Domestic residents purchased $75 million of oil from Saudi Arabia. B. Government spending on national defense was reduced by $1 billion. C. Businesses built 250 new apartment buildings. D. The government cut taxes by $100,000 million.

If the elasticity of supply of a good is zero, then its

A) supply curve is vertical. B) supply curve is horizontal. C) demand curve must be vertical. D) supply curve is positively sloped.

Which of the following statements is correct?

a. If the inflation rate is steady at 5 percent, for example, the real and nominal interest rates will be equal. b. An increase in the demand for goods now compared with goods in the future would cause the real interest rate to rise. c. A "positive rate of time preference" means that an individual would rather save than consume. d. During an extended inflationary period, the money (or nominal) interest rate will usually be lower than the real rate of interest.

Economists disagree on whether labor taxes cause small or large deadweight losses. This disagreement arises primarily because economists hold different views about

a. the size of labor taxes. b. the importance of labor taxes imposed by the federal government relative to the importance of labor taxes imposed by the various states. c. the elasticity of labor supply. d. the elasticity of labor demand.