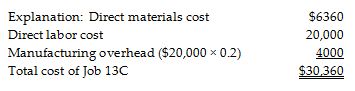

Venus Manufacturing uses a predetermined overhead allocation rate based on direct labor cost. At the beginning of the year, it estimated the manufacturing overhead rate to be 20% of the direct labor cost. In the month of June, Venus completed Job 13C and its details are as follows:

What is the total cost incurred for Job 13C?

A) $27,632

B) $24,000

C) $10,360

D) $30,360

D) $30,360

Business

You might also like to view...

The extreme risk of an activity is a defense against imposing strict liability

Indicate whether the statement is true or false

Business

When convertible bonds are converted to a company's stock, the carrying value of the bonds is transferred to equity accounts and no gain or loss is recorded.

Answer the following statement true (T) or false (F)

Business

Bankruptcy proceedings are held in state courts.

Answer the following statement true (T) or false (F)

Business

What is the ebusiness model that applies to customers offering goods and services to each other over the Internet?

A. C2C B. B2C C. C2B D. B2B

Business