A tax of $0.25 is imposed on each bag of potato chips that is sold. The tax decreases producer surplus by $600 per day, generates tax revenue of $1,220 per day, and decreases the equilibrium quantity of potato chips by 120 bags per day. The tax

a. decreases consumer surplus by $645 per day.

b. decreases the equilibrium quantity from 6,000 bags per day to 5,880 bags per day.

c. decreases total surplus from $3,000 to $1,800 per day.

d. creates a deadweight loss of $15 per day.

d

You might also like to view...

According to the Weak Coase Theorem, in the absence of transactions costs, the assignment of property rights has no effect on

a. damages paid by liable parties. b. the distribution of income. c. the allocation of resources. d. economic efficiency.

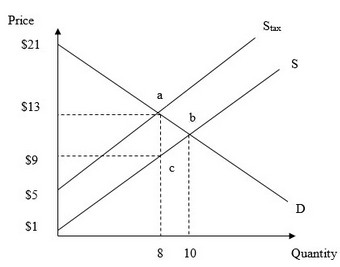

Use the figure below to answer the following question. What area represents producer surplus after the government imposes the excise tax on the market?

What area represents producer surplus after the government imposes the excise tax on the market?

A. triangle $21a$13 B. square $13ac$9 C. triangle abc D. triangle $1c$9

The figure above shows a production possibilities frontier. In the figure, which of the following combinations of the two goods are efficient?

A) 4 million cell phones and 4 million DVDs B) 2 million cell phones and 13 million DVDs C) 5 million cell phones and 15 million DVDs D) no cell phones and 15 million DVDs E) None of these combinations is efficient.

Black markets are associated with:

A. price floors and the resulting product surpluses. B. price floors and the resulting product shortages. C. ceiling prices and the resulting product shortages. D. ceiling prices and the resulting product surpluses.