Division A had ROI of 15% last year. The manager of Division A is considering an additional investment for the coming year. What step will the manager likely choose to take?

A) accept the investment as long as it provides positive operating income

B) accept the investment as long as its ROI is positive

C) reject the investment if it returns more than 15% ROI

D) reject the investment if it returns less than 15% ROI

E) reject the investment if it returns an ROI equal to 15%

D

You might also like to view...

Exculpatory clauses are generally unenforceable if they seek to avoid liability for:

A. negligence. B. accidental damages. C. better monetary benefit for one side. D. fraud or willful misconduct.

If a bride-to-be breaks her engagement, she generally must return the engagement ring under both the fault rule and the objective rule standards

Indicate whether the statement is true or false

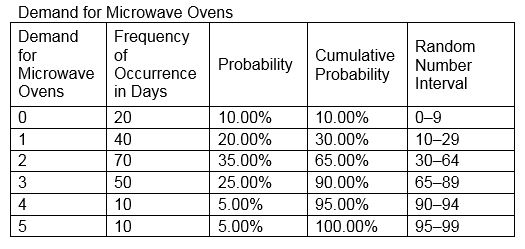

Consider the Demand for Microwave Ovens data set. What is the total demand corresponding to random numbers 87, 44, 3, 10, 26, and 39?

A. 8

B. 9

C. 10

D. 11

Ulysses bought Whiteacre from Gordon but never recorded the deed. Gordon stayed on the property as a tenant for three (3 ) years. Near the end of the three (3 ) years, Gordon learned that Ulysses had never recorded the deed. Gordon advertised Whiteacre

for sale and Cheryl negotiated with Gordon thinking that Gordon was the owner. Finally, Cheryl checked the records at the recording office and, finding no reason to question Gordon's ownership of the property, purchased Whiteacre from Gordon. Cheryl recorded the deed and Gordon fled with the purchase money. Meanwhile, Ulysses had failed to pay the real estate taxes on Whiteacre for the three (3 ) years in question thinking it was the responsibility of Gordon, the tenant. Ultimately, Cheryl and Ulysses disputed over the ownership of the property. Decide the case between Cheryl and Ulysses. Also decide whether Ulysses is responsible for the three (3 ) years of real estate taxes assessed while Gordon occupied the property as a tenant.