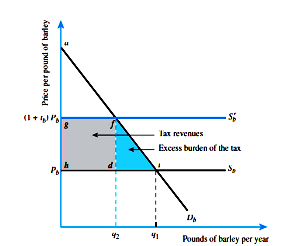

Refer to the figure below. Suppose that the demand curve for barley can be characterized by the equation P = 100 - 2Q d . Suppose further that price was $10.00 and a $10.00 tax is imposed on the market.

(A) How many barleys would be purchased at a price of $10.00? After tax?

(B) What is the amount of tax revenue generated by the tax?

(C) How much excess burden is generated by the tax?

(D) What is the amount of consumer surplus before and after the tax? What is the difference in

consumer surplus? Is it equal to excess burden plus the tax revenue?

(A) Q* = 45, Q* after tax = 40

(B) Tax revenue generated is (10)(40) = 400.

(C) Excess burden is (1/2)(10)(5) = 25.

(D) CS before tax = (1/2)(45)(100 - 10) = 2025

CS after tax = (1/2)(40)(100 - 20) = 1600

CS before tax - CS after tax = 2025 - 1600 = 425

You might also like to view...

Consider gardening books. What will happen to the market for these books as gardening becomes more popular and simultaneously printing costs increase?

A) The price of gardening books definitely increases. B) The quantity of gardening books definitely increases. C) The price of gardening books might increase or decrease. D) The quantity of gardening books definitely stays the same.

Which aspect of macroeconomics generates the most controversy?

A) economic growth B) the causes of business cycles C) supply and demand D) competitive equilibrium

Which of the following statements is true?

a. Exports tend to decrease economic efficiency. b. A nation should specialize in producing a good in which it has an absolute advantage. c. A nation should specialize in producing a good only when it has both an absolute and a comparative advantage. d. A nation should specialize in producing a good in which it has a comparative advantage. e. International trade does not reflect the benefits of specialization.

A neighborhood tree-planting program generates positive externalities

Indicate whether the statement is true or false