Saturn Co rented out office space to a tenant on January 1 and received a total of $90,000 for the first nine months of rent. The amount was recorded as Rent Collected in Advance when received. Adjustments are recorded only at the end of every quarter. What effect does the adjustment at March 31 have on Saturn's net income for the quarter ending March 31?

A) Increase by $90,000

B) Decrease by $60,000

C) Decrease by $30,000

D) Increase by $30,000

D

You might also like to view...

Available-for-sale securities are securities that management expects to sell in the future, but are not actively traded for profit

Indicate whether the statement is true or false

The Crown Howe accounting firm rents a skybox at Lucas Oil Field where the Indianapolis Colts plays their home games. The cost of the skybox for the season is $80,000 and includes 8 tickets to each game. The team plays 10 games a year at the arena. The most expensive non-luxury box seat is $200. After acquiring a new accounting client, the managing partner invites 5 business associates to watch a game in the firm skybox. What amount can Crown Howe deduct as an entertainment expense?

A. $0 B. $1,000 C. $1,200 D. $2,400 E. $4,400

What are the steps in using the semantic differential to measure people's perceptions of an organization and the behaviors of a particular group with respect tot he organization?

What will be an ideal response?

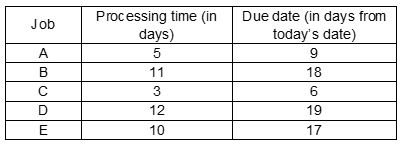

The makespan for the jobs listed in the following table under the earliest due date (EDD) rule is ______.

A. 41 days

B. 50 days

C. 40 days

D. 55 days