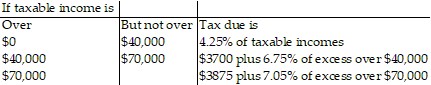

Solve the problem.The following table shows a recent state income tax schedule for married couples filing a joint return in State X.State X Income TaxSCHEDULE I - MARRIED FILING JOINTLY (i) Write a piecewise definition for the tax due T(x) on an income of x dollars. (ii) Graph T(x). (iii) Find the tax due on a taxable income of $50,000. Of $95,000.

(i) Write a piecewise definition for the tax due T(x) on an income of x dollars. (ii) Graph T(x). (iii) Find the tax due on a taxable income of $50,000. Of $95,000.

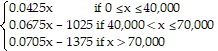

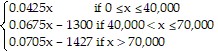

A. (i)

T(x) =

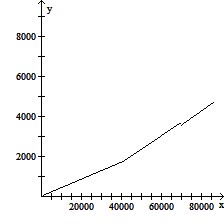

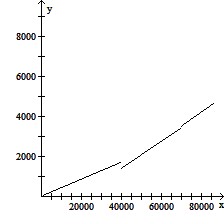

(ii)

(iii) $2385; $5697.50

B. (i)

T(x) =

(ii)

(iii) $2350; $5322.50

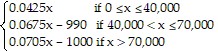

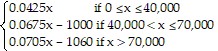

C. (i)

T(x) =

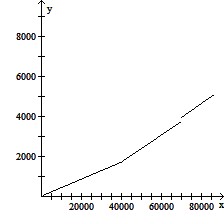

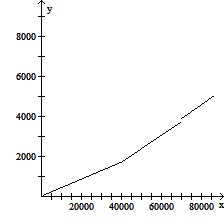

(ii)

(iii) $2375; $5637.50

D. (i)

T(x) =

(ii)

(iii) $2075; $5270.50

Answer: C

Mathematics

You might also like to view...

Use an Euler diagram to determine whether the argument is valid or invalid.Not all that glitters is gold.My ring glitters. My ring is not gold.

A. Valid B. Invalid

Mathematics

Solve the problem.Given the velocity and initial position of a body moving along a coordinate line at time t, find the body's position at time t.v = -8t + 8, s(0) = 12

A. s = -8t2 + 8t + 12 B. s = - 4t2 + 8t + 12 C. s = - 4t2 + 8t - 12 D. s= 4t2 + 8t - 12

Mathematics

Graph the equation.(x - 1)2 = 8(y + 1)

A.

B.

C.

D.

Mathematics

Solve. = 4

= 4

A. 64 B. 59 C. -1 D. 11

Mathematics