After a firm has identified an appropriate targeting strategy, the next step in the target market selection process is

A. determining the demographic variables of the target market.

B. developing market segment profiles.

C. determining which segmentation variables to use.

D. selecting specific target markets.

E. evaluating relevant market segments.

Answer: C

You might also like to view...

A mixed cost has both fixed and variable elements

Indicate whether the statement is true or false

A global company that has the ability to successfully transform a domestic campaign into a worldwide one or to create a new global campaign from the ground up possesses a critical marketing advantage

Explain this statement in light of the global advertising.

Skyline Builders and Pine Lumber had a contract, calling for Pine Lumber to deliver a certain quantity of bricks to Skyline's place of business on the first of every month for one year. Pine delivered the bricks one week late for the first six months, but Skyline did not object. When Pine delivered the bricks one week late, as usual, in the seventh month, Skyline attempted to cancel the contract because of the late delivery. Which of the following is true about this scenario?

A. Skyline has waived its right to cancel the contract. B. Pine is not in breach because the delivery was made at the intended place of business. C. Pine will have to return the delivery fee of the first six months because it broke the contract. D. Skyline does not have the legal right to modify the contract.

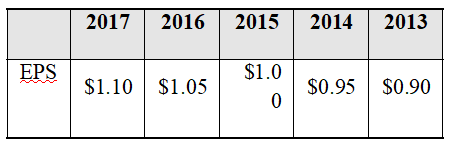

The Claustrophobic Solution, Inc., a residential window and door manufacturer, has the following historical record of earnings per share (EPS) from 2013 to 2017:

The company’s payout ratio has been 60% over the last five years and the last quoted price of the firm’s stock was $10. Flotation costs for new equity will be 7%. The company has 30,000,000 common shares outstanding and a debt-equity ratio of 0.50.

a) If dividends are expected to grow at the same arithmetic average growth rate of the last five years, what is the dividend payment in 2018?

b) Calculate the firm’s cost of retained earnings and the cost of new common equity using the constant growth dividend discount model.

c) Calculate the break-point associated with retained earnings.

d) If the Claustrophobic Solution’s after-tax cost of debt is 9%, what is the WACC with retained earnings? With new common equity?

e) Assuming that the cost of debt is constant, create a marginal cost of capital (MCC) schedule. Be sure to use a Scatter chart and make it a step function.