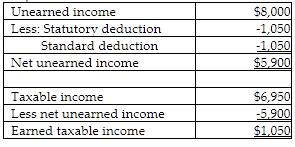

Satish, age 11, is a dependent of his parents. His only source of income in 2018 is $8,000 of interest income on bonds given him by his grandparents, resulting in taxable income of $6,950. Under kiddie tax rules, calculation of tax requires dividing taxable income between net unearned income and earned taxable income. Satish's taxable income will be divided as follows:

A) net unearned income -$6,950 and earned taxable income -$0.

B) net unearned income -$5,900 and earned taxable income -$1,050.

C) net unearned income -$0 and earned taxable income -$6,950.

D) net unearned income -$8,000 and earned taxable income -$1,050.

B) net unearned income -$5,900 and earned taxable income -$1,050.

You might also like to view...

Auditing exists because users need unbiased information on which to assess management performance and make economic decisions

a. True b. False Indicate whether the statement is true or false

________ is a budgeting guideline that recognizes employees affected by a budget should be involved in preparing it.

What will be an ideal response?

The total amount that can be borrowed is the firm's:

A) Line of credit B) Max credit C) Line limit D) Credit limit

Virtual worlds and social networking are drivers of e-learning

Indicate whether the statement is true or false