Scott and Cindy both produce only pizza and tacos. In one hour, Scott can produce 20 pizzas or 40 tacos. In one hour, Cindy can produce 30 pizzas or 40 tacos. Based on these data,

A) Cindy has a comparative advantage at producing tacos.

B) Scott has a comparative advantage at producing tacos.

C) Cindy and Scott have the same comparative advantage in producing tacos.

D) neither Cindy nor Scott has a comparative advantage in producing tacos.

E) Cindy and Scott have the same comparative advantage in producing pizzas.

B

You might also like to view...

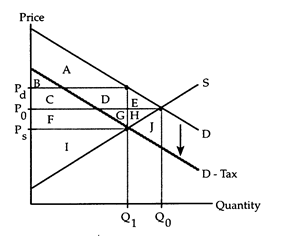

Refer to Sales Tax. After the tax is imposed, consumers' surplus is equal to

The following questions refer to the accompanying diagram which shows the effects of a sales tax imposed on consumers. The initial price and quantity are P0 and Q0, respectively. After the tax is imposed, the equilibrium quantity is Q1, firms receive the price Ps, and consumers pay the price Pd.

a. area A + B.

b. area B.

c. area B + C.

d. area A + B + C + D + E.

If the cross-price elasticity of demand between blueberries and yogurt is negative, then the two goods are:

A. normal goods. B. inferior goods. C. substitutes. D. complements.

The market interest rate

a. represents the opportunity cost of investing with borrowed funds b. has no impact on the firm's investment decision if the firm uses borrowed funds c. represents the opportunity cost of investing with savings d. has no impact on the firm's investment decision if the firm uses savings e. represents the opportunity cost of investing with either borrowed funds or savings

The supply curve of a natural resource like oil has a positive slope because

a. the supply becomes closer to exhaustion as demand rises. b. it becomes more costly to find and develop supplies as demand rises. c. rents rise as output increases. d. indirect taxes rise with output.