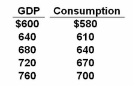

Refer to the above information. If planned investment was $20 billion, government purchases of goods and services were $20 billion, and taxes and net exports were zero, then the equilibrium level of GDP would be:

The table shows a consumption schedule. All figures are in billions of dollars.

A. $600 billion

B. $640 billion

C. $680 billion

D. $720 billion

C. $680 billion

You might also like to view...

The provision of a legal system is an important economic function of the government because

A) lawyers and judges tend to be high-income people. B) people need to feel safe when they go to work. C) the legal system affects how exchange takes place through its enforcement of contracts. D) the legal system affects the distribution of income through its awarding of damages in accident claims.

An example of a final good is:

A. chocolate chips purchased by Nabisco to make Keebler chocolate chip cookies. B. chocolate chips purchased by you to make chocolate chip cookies. C. chocolate chips purchased by a restaurant to make a chocolate chip cookie pie to sell. D. chocolate used to make Cocoa Rice Krispies.

When a tax is imposed on sellers, producer surplus decreases but consumer surplus increases

a. True b. False Indicate whether the statement is true or false

"Tax cuts, by providing incentives to work, save, and invest, will raise employment and lower the price level." This argument is made by the:

A. Keynesian economists. B. supply-side economists. C. classical economists. D. monetarists.