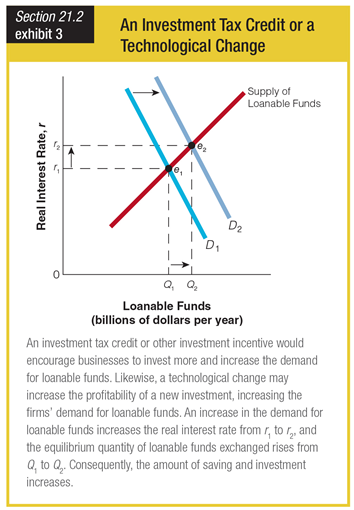

Based on the graph showing the effects of an investment tax credit or a technological change, enacting an investment tax credit would ______.

a. increase the demand curve for loanable funds

b. decrease the demand curve for loanable funds

c. increase the supply curve for loanable funds

d. decrease the supply curve for loanable funds

a. increase the demand curve for loanable funds

You might also like to view...

If the supply of a factor is perfectly inelastic, then

A) no more than the existing quantity can be supplied. B) the supply curve is horizontal. C) sellers will provide whatever quantity is demanded at the going price. D) a fall in price results in no quantity being supplied.

Which of the following products is most likely to be sold in a monopolistically competitive market?

A) fast food B) coal C) wheat D) electricity

Economic growth is:

A. about the quality of life for all sectors of society. B. an indicator of individual poverty. C. a measurement of available resources. D. the measure of changes in real GDP.

Which of the following is a macroeconomic subject?

a. umbrellas produced by a firm b. wages earned by a firm producing umbrellas c. cost of producing military aircraft d. savings in the national economy e. profit earned by a firm producing military aircraft