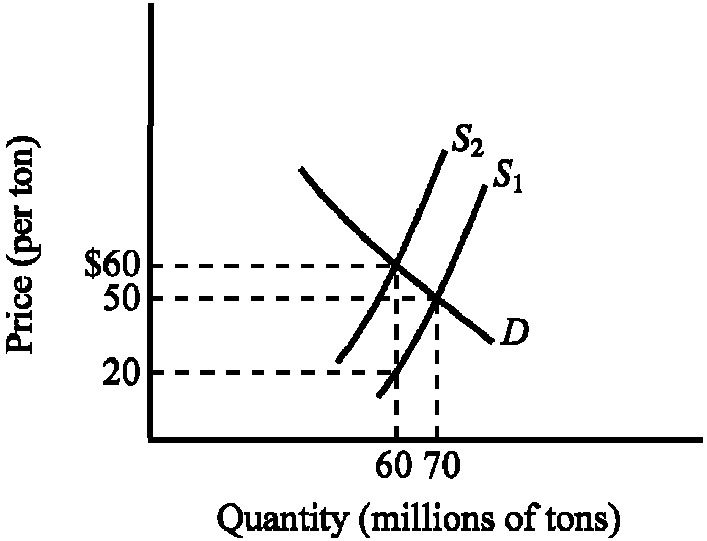

Figure 4-8

Refer to . The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

a.

$10 for buyers and $30 for sellers

b.

$30 for buyers and $10 for sellers

c.

The entire $40 falls on sellers.

d.

The entire $40 falls on buyers.

a

You might also like to view...

The tables above show a nation's labor demand and labor supply schedules and its production function. The equilibrium real wage rate is ________ and the equilibrium quantity of labor is ________ billion hours per year

A) $50; 100 B) $40; 90 C) $30; 80 D) $40; 80 E) $20; 110

Under sticky prices

A) a fall in the money supply raises the interest rate to preserve money market equilibrium. B) a fall in the money supply reduces the interest rate to preserve money market equilibrium. C) a fall in the money supply keeps the interest rate intact to preserve money market equilibrium. D) a fall in the money supply does not affect the interest rate in the short run, only in the long run. E) a fall in the money supply raises the interest rate to preserve money market equilibrium in the long run.

Vertical restraints in a contract

A) are generally illegal in the U.S. B) usually benefit the firm that produces the raw inputs to the production process. C) are used in vertical mergers. D) can approximate the outcome of a vertical merger.

What is the difference between economic and accounting profit? Why is a distinction between them important?