Assuming proper documentation is maintained, Joe may deduct

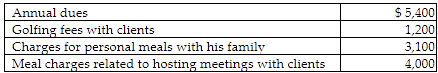

Joe is a self-employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses include the following:

A) $2,000.

B) $2,600.

C) $5,300.

D) $4,000.

A) $2,000.

He gets no deduction for the dues, golfing fees, or the personal meals. Business meals are 50% deductible for self-employed individuals. ($4000 × .50) = $2,000

You might also like to view...

Tony Pool Chemical Co purchased 144 buckets of chlorine tablets over the Internet from Chemical, Inc, then placed the order with the manufacturer and arranged for its transportation by truck to the Tony Pool store

Chemical, Inc took title to the pool chemicals but never actually took possession of them. Chemical, Inc is an example of a ________. A) drop shipper B) truck jobber C) rack jobber D) mail-order wholesaler E) cash-and-carry wholesaler

The best prospects for corporate fundraising will be when

a. the corporation wants to use philanthropy as a competitive weapon b. the nonprofit can easily show the corporation that it will get strategic payoffs c. the endeavor will provide the corporation with tax deductions or reductions d. the corporation has a formal donations policy e. the nonprofit has representative from that corporation on its board

Any contract involving a sale of goods of $100 or more must be in writing

a. True b. False Indicate whether the statement is true or false

In the context of consumerism,smart businesses view customer complaints asan opportunity to create better products and stronger relationships.

Answer the following statement true (T) or false (F)