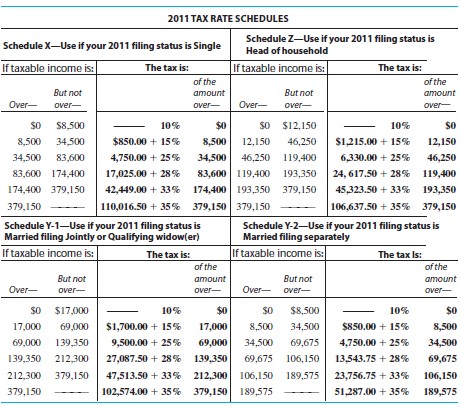

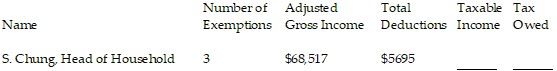

Find the amount of taxable income and the tax owed. The letter following the name indicates the marital status, and all married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the following tax rate schedule.

A. $56,317; $8846.75

B. $51,722; $7698.00

C. $59,122; $9548.00

D. $48,917; $6996.75

Answer: D

Mathematics

You might also like to view...

Decide whether or not the events are mutually exclusive.Speaking Spanish and speaking Chinese

A. Yes B. No

Mathematics

Determine whether the statement is true or false. 9 ? {1, 3, 5, 7, 9}

A. True B. False

Mathematics

Fill in the missing value.0.294 hL = L

A. 294 B. 0.0294 C. 29.4 D. 2.94

Mathematics

Choose the most reasonable unit of measure.Pencil width: 0.6  (in., ft, yd, mi)

(in., ft, yd, mi)

A. ft B. yd C. in. D. mi

Mathematics