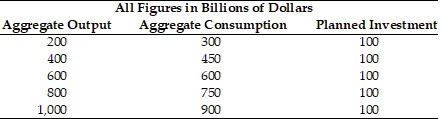

Refer to the information provided in Table 23.7 below to answer the question(s) that follow. Table 23.7 Refer to Table 23.7. At an aggregate output level of $400 billion, planned expenditure equals

Refer to Table 23.7. At an aggregate output level of $400 billion, planned expenditure equals

A. $450 billion.

B. $500 billion.

C. $550 billion.

D. $850 billion.

Answer: C

You might also like to view...

With a tax of $4,000 on $24,000 taxable income, the average tax rate is

A. 16.67%. B. 23.45%. C. 20%. D. 25%.

The United States has less income inequality than

a. Ethiopia. b. United Kingdom. c. Vietnam. d. Mexico.

The largest source of tax revenue for the U.S. federal government is:

A. personal income taxes. B. property taxes. C. corporate income taxes. D. sales and excise taxes.

Which of the following is an example escape clause relief?

A) A tariff is granted because foreign firms are selling below cost. B) A temporary tariff is granted to allow for adjustment of the domestic industry. C) A tariff is granted to an industry because foreign firms are subsidized by their governments. D) A tariff is granted to an industry because another nation persistently uses unfair trade practices.