The income tax requires that taxpayers pay 10 percent on the first $50,000 of income and 20 percent on all income over $50,000 . Andy paid $9,000 in taxes. What were his marginal and average tax rates?

a. 20 percent and 13 percent, respectively

b. 20 percent and 15 percent, respectively

c. 10 percent and 13 percent respectively

d. 10 percent and 15 percent respectively

a

You might also like to view...

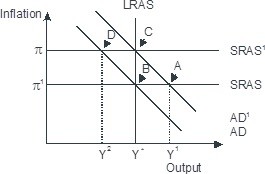

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

If a person's compensated demand (or MWTP) curve is perfectly vertical, the good is borderline between regular inferior and Giffen for this consumer.

Answer the following statement true (T) or false (F)

If the central bank buys foreign assets,

A) the domestic monetary base will decline. B) domestic short-term interest rates will decline. C) the foreign-exchange value of the domestic currency will rise. D) its holdings of international reserves will rise.

Which of the following statements concerning pollution is correct?

A) Economic efficiency requires that pollution be completely eliminated. B) Economic efficiency dictates that the optimal amount of pollution arises at the point at which price equals private marginal cost. C) Pollution should be reduced to the point at which the marginal benefit from further reduction equals the marginal cost of further reduction. D) Pollution should be reduced to the extent necessary to return production to the production possibilities frontier.