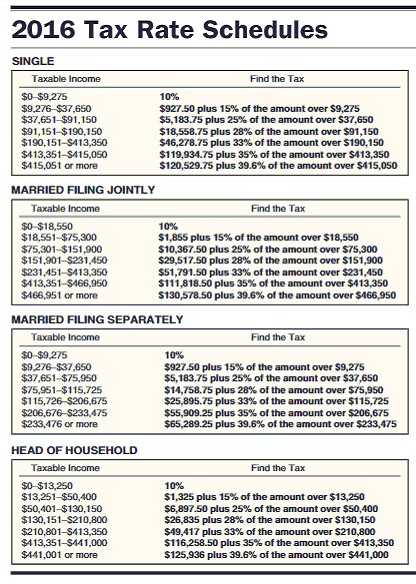

Find the tax in the following application problems. Use $4050 for each personal deduction, a standard deduction of $6300 for single taxpayers, $12,600 for married taxpayers filing jointly, $6300 formarried taxpayers filing separately, and $9300 for head of household and the tax rate schedule. The Greenwoods had an adjusted gross income of $57,492 last year. They had deductions of $1,095 for state income tax, $4,205 for property tax, $5,320 in mortgage interest, and $2,261 in contributions. The Greenwoods claim four exemptions and file a joint return.

The Greenwoods had an adjusted gross income of $57,492 last year. They had deductions of $1,095 for state income tax, $4,205 for property tax, $5,320 in mortgage interest, and $2,261 in contributions. The Greenwoods claim four exemptions and file a joint return.

A. $3,334.15

B. $5,841.65

C. $3,813.80

D. $4,902.75

Answer: A

Mathematics

You might also like to view...

Use a calculator to evaluate the expression. (Round your answer to three decimal places.)

A. 1.523 × 1010 B. 1.523 × 1011 C. 3.222 × 109 D. 3.222 × 1011 E. 3.222 × 1010

Mathematics

Find the value of 2x2 + y + 6 when x = 4 and y = 2.

a. 64 b. 40 c. 82 d. 86 e. 92

Mathematics

Write the improper fraction as a mixed or whole number.

A. 77

B.

C. 935

D. 935

Mathematics

Find the present value or future value. Round to the nearest cent.Present Value: $4000Interest Rate: 7 %Time: 24 daysFuture value:

%Time: 24 daysFuture value:

A. $4540.00 B. $4019.33 C. $4632.73 D. $3493.45

Mathematics