If the Fed sells bonds through its open market operations, then there is

A. an increase in the supply of bonds and a fall in the price of existing bonds.

B. a decrease in interest rates because of the increase in the supply of bonds.

C. an increase in the demand for bonds and a rise in the price of existing bonds.

D. a decrease in interest rates because of the decrease in the demand for bonds.

Answer: A

You might also like to view...

If the price of good X goes up and the price of good Y goes down, then it is possible for

a. The person is better off than before. b. The person is worse off than before. c. The person is no better or worse off than before. d. All of the above are possible.

Which of the following is FALSE regarding a monopsonist?

A. The monopsonist faces the entire market labor supply curve. B. The monopsonist faces an upward sloping labor supply curve. C. The monopsonist is the only buyer in a market. D. The monopsonist faces an upward sloping labor demand curve.

Checkable deposits include:

A. both large and small-denominated time deposits. B. the deposits of banks and thrifts on which checks can be written. C. only the checkable deposits of commercial banks. D. only the checkable deposits of thrift institutions.

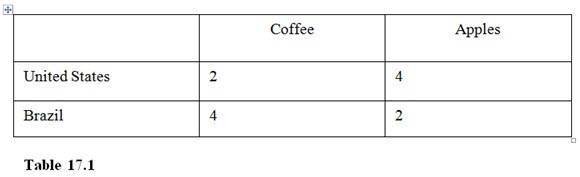

In Table 17.1, Brazil has

A. an absolute and comparative advantage in coffee. B. an absolute and comparative advantage in both goods. C. an absolute advantage but not a comparative advantage in coffee. D. an absolute and comparative advantage in apples.